georgia ad valorem tax out of state

Use Ad Valorem Tax. Ad valorem tax georgia.

Car Tax By State Usa Manual Car Sales Tax Calculator

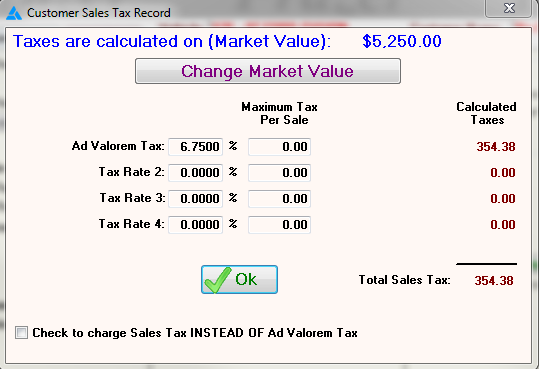

You can calculate the Title Ad Valorem Tax by finding the.

. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and. The Ad Valorem Tax or the Property Tax is based on value. Learn how Georgias state tax laws apply to you.

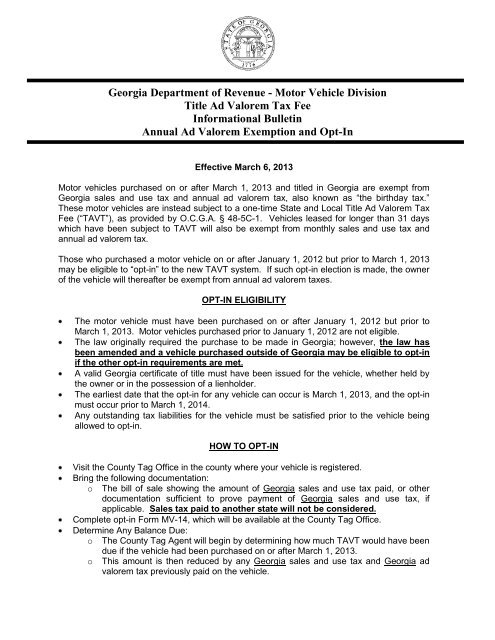

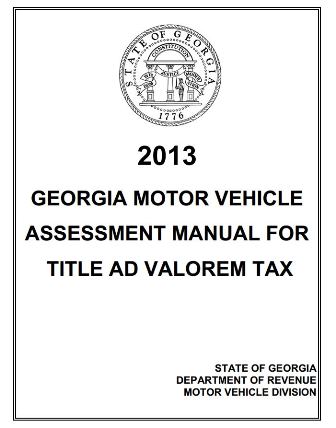

As a result the annual vehicle ad valorem tax sometimes called the birthday tax is being changed to a state and local title ad valorem tax or TAVT. Thereafter there is no annual ad valorem tax but an additional TAVT applies each time. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later.

In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. If you buy a car out of state and register it in Georgia then there is a 4 state sales tax instead of the TAV Tax.

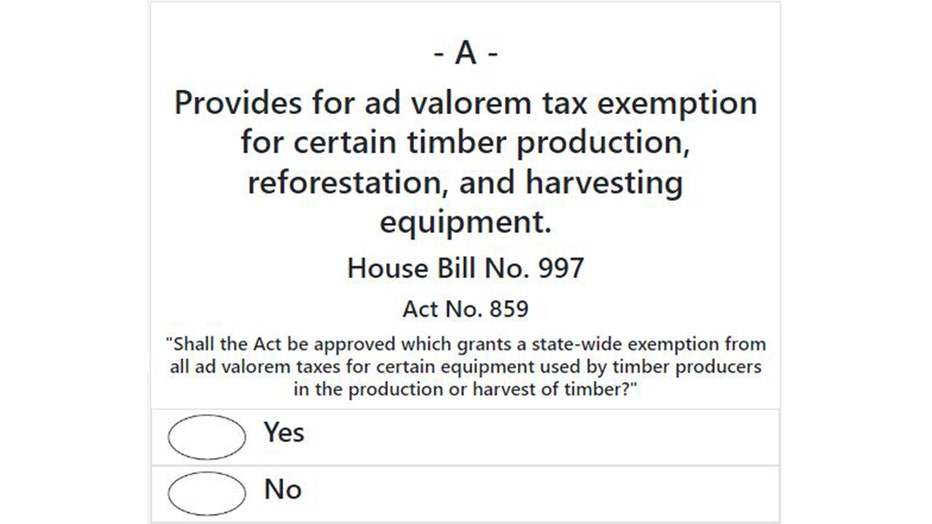

As of 2018 residents in most Georgia counties pay a one. Under current state law family-owned farms are exempt from ad valorem tax on a lot of their equipment. I want to buy a car in a different state which has also has a sales.

For the answer to this question we consulted the Georgia Department of Revenue. Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. The Property Tax is part of a well balanced revenue system that is designed to spread the tax burden to all citizens who benefit.

The Latin phrase ad valorem can be commonly defined as according to value In the state of Georgia individuals who own a motor vehicle are required to pay a one-time ad. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. As of 2018 residents in most Georgia counties pay a one.

Andres Villegas of the Georgia Forestry Association said timber. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. For context Georgia charges a 7 Ad Valorem tax on obtaining a Georgia registration and title 7 of the fair market value.

The TAVT imposes a title tax at the time of purchase or initial registration in the state.

Birthday Tax To Disappear On Vehicles Purchased After March 1 Gordon County Government

2018 Heyward Allen Toyota Georgia Tax Info

Property Taxes Calculating State Differences How To Pay

Georgia Property Tax Calculator Smartasset

Understanding Your Property Tax Bill Department Of Taxes

Tax Exemptions For Senior Homeowners In Georgia Red Hot Atlanta Homes Active Adult Experts

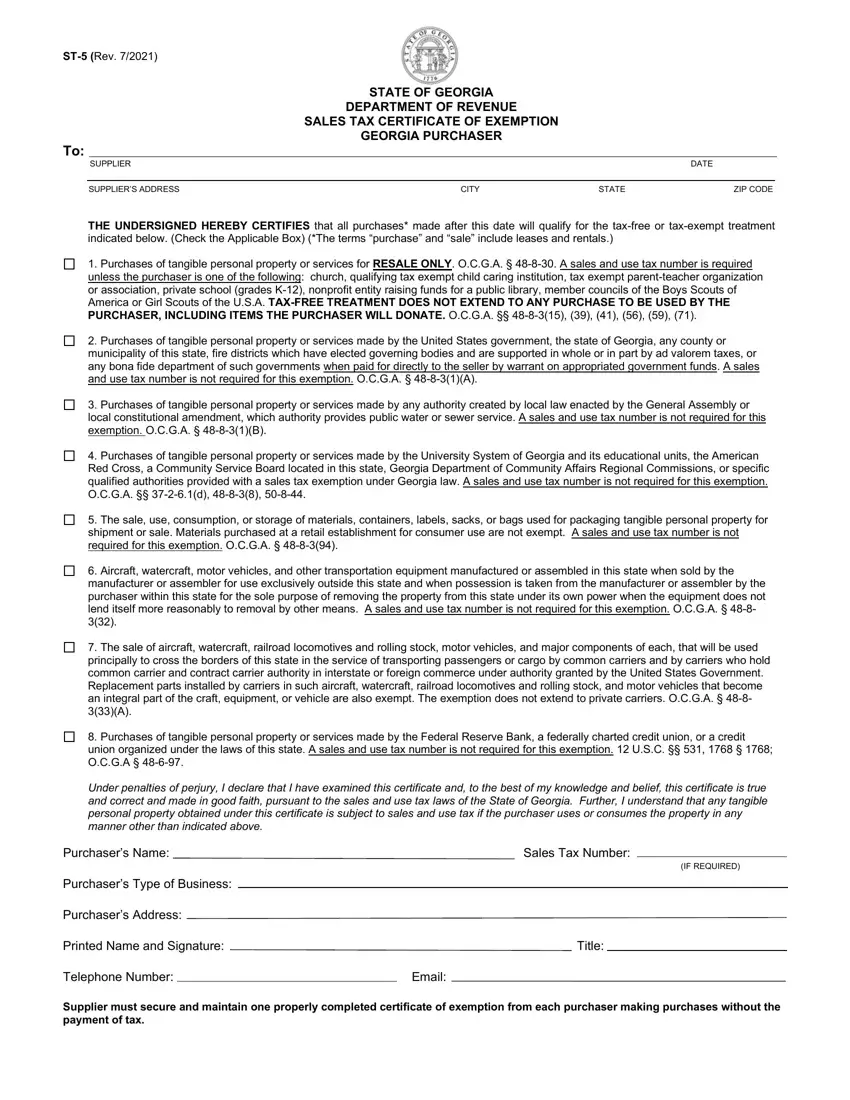

Georgia Form St 5 Fill Out Printable Pdf Forms Online

Georgia Department Of Revenue Motor Vehicle Division Title Ad

Frazer Software For The Used Car Dealer State Specific Information Georgia

Georgia 2022 Statewide Ballot Questions Explained

Get A Library Card Clayton County Library System

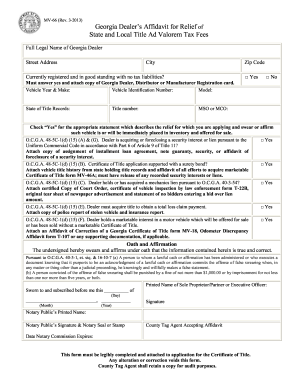

Ga Mv 66 2013 2022 Fill Out Tax Template Online

Form T 146 Fillable Irp Exemption To Title Ad Valorem Tax Fee Application

Gwinnetttaxcommissioner Motor Vehicle General Titling Register My Vehicle If I M New To Georgia

Newly Purchased Car Registration Tags Douglas County Ga

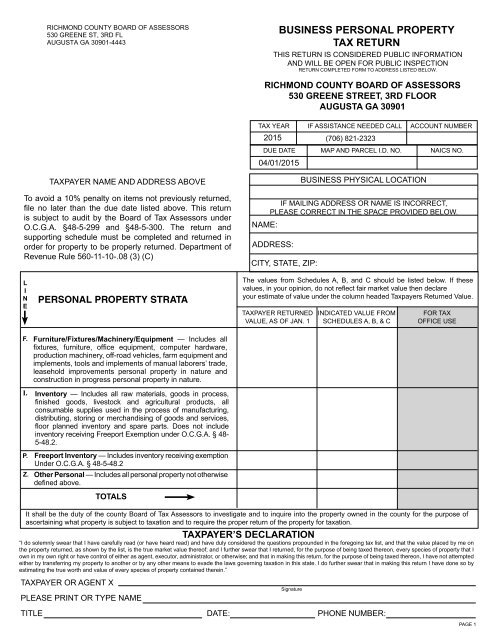

Business Personal Property Tax Return Augusta Georgia

2013 Vehicle Valuation Manual Title Ad Valorem Tax Diminished Value Of Georgia